You work hard, and you should be fairly compensated for it. Unfortunately, employers aren’t always fair with how they pay their employees. Unfair pay is when an employee isn’t paid what they are owed or is not given the right amount of their paycheck at the right time. This is also called withholding funds from an employee.

Contact KCNS Law Group today if you think your employer is deducting your pay unfairly. The tips in this article will help you negotiate fairer terms with your employer, along with letting you know what to look out for in the future in case this happens again.

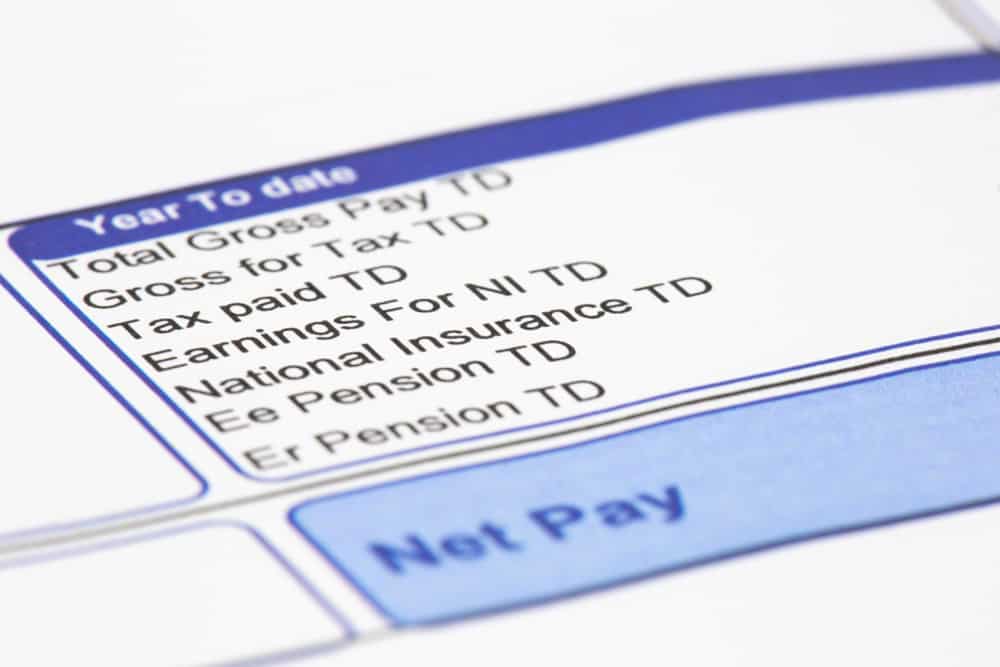

Deductions from your paycheck are amounts that your employer is legally allowed to deduct from your pay. These deductions may be for taxes, insurance, retirement plans, charitable donations, or other purposes. Your employer must follow federal and state law when making deductions from your pay.

For most deductions, your employer must have your written consent. However, your employer could also deduct taxes and amounts required by federal or state law without your consent. Your employer may also withhold amounts from your paycheck if you owe the company money.

Some deductions may reduce the amount of overtime pay you receive as well. Or, if you are required to wear a uniform, your employer may deduct the cost of the uniform from your pay. However, the deduction cannot lower your pay below the minimum wage.

An employer typically withholds pay from an employee for taxes and other mandatory deductions. An employer may also deduct amounts from an employee’s pay if the employee has authorized the deduction in writing, such as for health insurance premiums or retirement savings contributions. An employer generally has the right to deduct other amounts from an employee’s pay if the deduction is required by state or federal law, such as for child support payments.

Most states have laws that protect workers from having their wages garnished or taken directly out of their paychecks for things like child support or unpaid taxes. These laws vary from state to state, but they typically limit how much an employer can deduct from a paycheck at one time.

If you do not agree with a deduction that your employer has made, you can make a claim. Your employer may have made a mistake when calculating the deduction, or you may be entitled to certain deductions that they have not included. If you are not sure whether or not you can claim a deduction, you should speak to your employer, an accountant, or a team of lawyers.

It is always a good idea to try to use internal channels to address pay problems within your company first. However, those channels may not be effective. If you fail to get a response that you are satisfied with, then it may be time to ask lawyers for help.

Lawyers can step in and address the problem on your behalf in several ways. The potential for legal action against the company can change how the company thinks about the situation. This is especially true if the company is in the wrong according to local, state, and federal laws.

The lawyers at KCNS Law Group can also review your situation and give you the best legal advice to help you decide what to do next. In any case, having our team of lawyers on your side can be a major benefit and take away a lot of the stress of making difficult decisions and protecting your rights. Contact us online or call us at (818) 937-9255 to discuss your case.